Hedge Against Inflation

As the value of paper currencies declines, precious metals may retain their purchasing power. Gold and silver have historically outpaced inflation, making them an important component of a balanced portfolio. Gold has also, historically, had an inverse relationship to the US dollar. Being rare commodities with intrinsic value guarantees their demand, regardless of the prevailing economic situation.

1. "Safe Haven" Against Declining Dollar

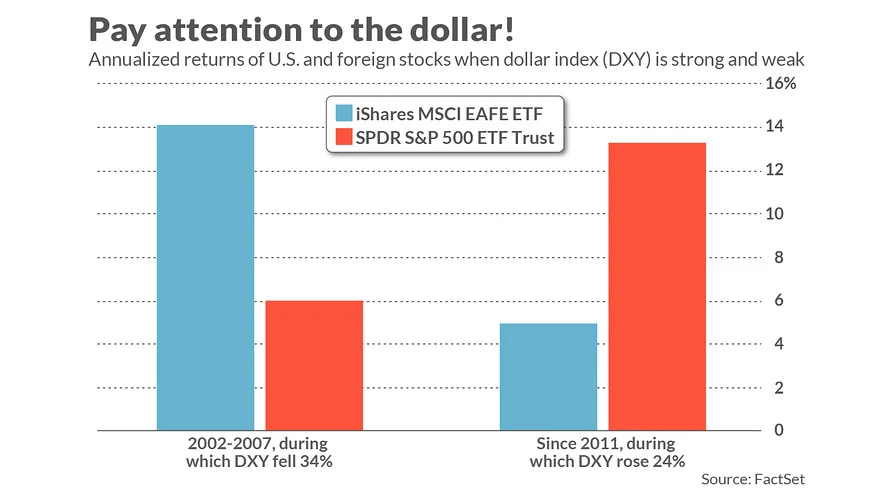

Investors have relied on gold as a “safe haven” in times of economic turmoil for centuries. In the 21st-century economy, the declining US dollar can keep any investor nervous. The value of the US dollar against other currencies has far-reaching implications for American investors. Over the last two decades, US stocks delivered better gains when the US dollar was strong than when it is weak.

Betting all your resources and financial future only on paper assets is a recipe for disaster. The adage “don’t put all your eggs in one basket” comes to mind. The bottom line? If you’re worried about the declining US dollar, diversify your portfolio. Unlike stocks, bonds, and mutual funds, the price of gold always rises the most in trying times. Investing in precious metals is an effective way to diversify your portfolio. As an investor, you can rely on gold as a "safe haven" against the declining US dollar.

To experience all the benefits of buying precious metals, invest with a reputable dealer like Goldline.

Goldline has over 60 years of experience in the precious metals sector. You can rely on Goldline to buy gold, silver and platinum . With Goldline’s Accumulation Program, investors can acquire precious metals for as little as $200/month. To invest in precious metals with a reliable partner, contact us today!

2. Safe Way to Grow Wealth During Uncertain Economic Times

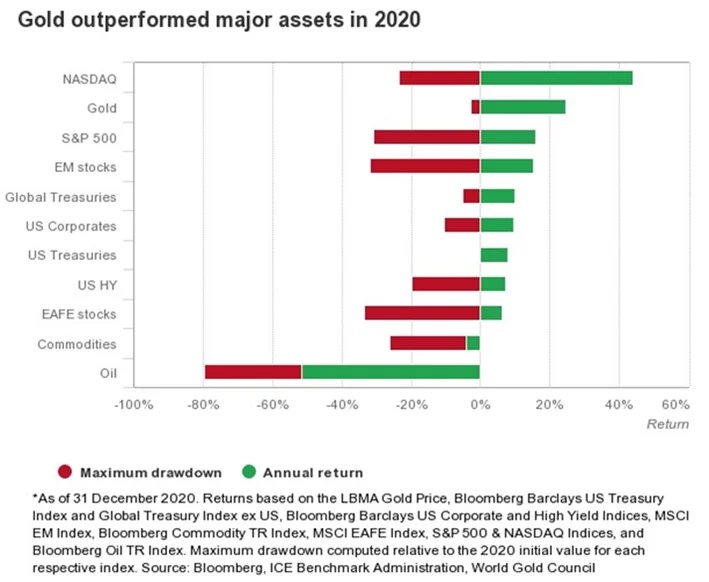

Since 2000, American investors have lost money to the dot-com bubble burst, the stock market crash, and the 2009 housing bubble burst. Gold and silver remained relatively stable during this period. In 2020, gold outperformed most traded assets.

In these uncertain times, investing in gold and silver offers higher stability and growth than other assets. As an investor, buying precious metals is the safest way to hedge against economic calamity.

3. Rising Gold and Silver Prices

Historically, the stock market was the go-to option for high, short-term profit gains. But stocks have become increasingly volatile and unpredictable in the past decade. From 2005 to 2020, gold prices increased by 330%, while the Dow Jones Industrial Average (DJIA) rose by only 153%. In August 2020, the price of gold reached a historical high of $2,067 per ounce. Buying gold offers a fast-growing long-term investment without the volatility of the stock market.

The price of silver has more than doubled in the past five years. In 2016, silver was $14/ounce. It increased to $18/ounce within a year and reached close to $20/ounce by 2019. In July 2021, silver prices surged past $28. It is not too late to get on this profitable train. Gold and silver prices may rise further in 2022 as more investors buy these precious metals to hedge against economic turmoil. Now maybe the best time to invest in gold and silver!

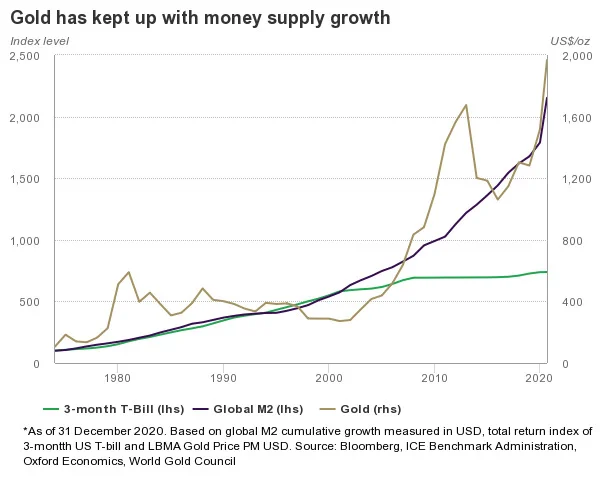

4. Hedge Against Inflation

Precious metals are rare commodities with intrinsic value, which guarantees demand regardless of the prevailing economic situation. In 2021, governments are increasing spending to jump-start their economies. Gold keeps up with the money supply but performs better amid high inflation. Gold's prices increase by 15% on average when inflation is higher than 3%.

Unlike other investments, no one can build or print more gold and saturate the market. Banks can invest more in the real estate market, increase supply, and devalue your property investment within a few months. When you invest in gold, you don’t have to worry about market saturation and asset devaluation. Increased demand for gold always leads to higher prices. According to World Gold Council’s 2021 outlook report, investment demand for gold will remain high throughout the year. To exploit this fast-growing investment opportunity, buy gold today!

5. Increasing Use Cases and Value

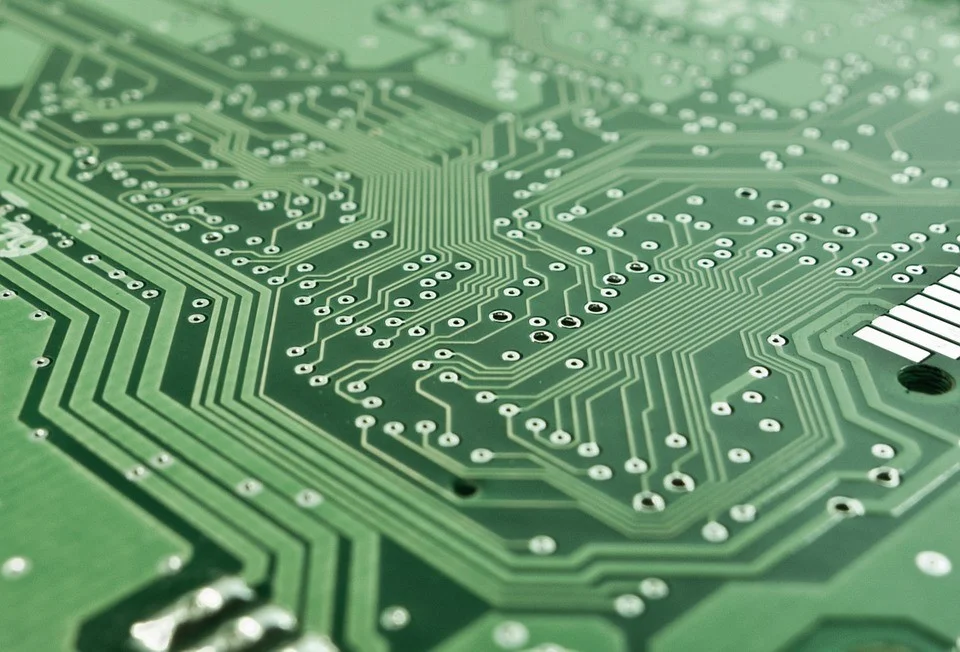

Although gold and silver are synonymous with high-end jewelry, they have multiple use cases. Both gold and silver have high electrical conductivity, ideal for circuit boards. They are used in modern industrial processes to manufacture electronics, including computers, smartphones, TVs, and video game consoles.

In the healthcare sector, medical practitioners use gold to treat lagophthalmos and other medical conditions. The value of gold, silver, and platinum will only increase in the future as technological innovations create new use cases. Buying precious metals is a profitable long-term investment.

Throughout history, precious metals like gold, and silver have been a part of the economic aspect of life. Gold and silver are synonymous with wealth generation and wellbeing, which is why they adorned the crowns of kings and queens.