What Is Dollar-Cost Averaging?

Dollar-Cost Averaging (DCA) is a flexible investment strategy that allows you to purchase assets by dividing and spreading your capital over a specific period. Using DCA investing with precious metals, investors contribute a certain amount on a fixed schedule to buy gold, silver, or platinum coins and/or bars.

For example, instead of buying gold coins worth $10,000 in one go, you can invest $500 in gold per month over 20 months. DCA investing is an effective way to buy gold, silver, or Platinum over time. How does DCA investing with precious metals work? Below are two ways to invest in gold, silver, or platinum using Dollar-Cost Averaging.

1. Precious Metals Accumulation Program

Reputable dealers in precious metals like Goldline offer DCA programs to help investors acquire gold, silver, and platinum. With Goldline’s Accumulation Program, you can invest as little as $200 per month towards gold, silver, and platinum coins and/or bars. Here is an example of an accumulation program for silver over five months:

| Period | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 |

|---|---|---|---|---|---|---|

| Amount Inv. | $200 | $200 | $200 | $200 | $200 | $1,000 |

| Silver Prices. | $25/oz | $20/oz. | $10/oz | $20/oz | $25/oz | $21.73/oz |

| Silver Owned | $200=8 oz | $200=10 oz | $200=20 oz | $200=10 oz | $200=8 oz | $1,000=46 oz |

After five months, you’ll own 46 ounces of silver worth more than the $1,000 invested. Precious metals accumulation programs make it easy for beginners to build long-term investments.

2. Gold Savings Account

Let’s say gold sells for around $1,805 per ounce. If you don't have $1,805 on hand, consider using a gold savings account. This dollar cost averaging plan allows investors to save small amounts over time to purchase assets beyond their reach. You can invest $300 into your gold savings account per month and over time you will own a whole once of gold.

Benefits of DCA Investing with Precious Metals

Whether you’re a beginner or a seasoned investor, DCA can help you invest in precious metals without unnecessary risks. DCA investing with precious metals offers several benefits.

1. Take Advantage of Price Dips

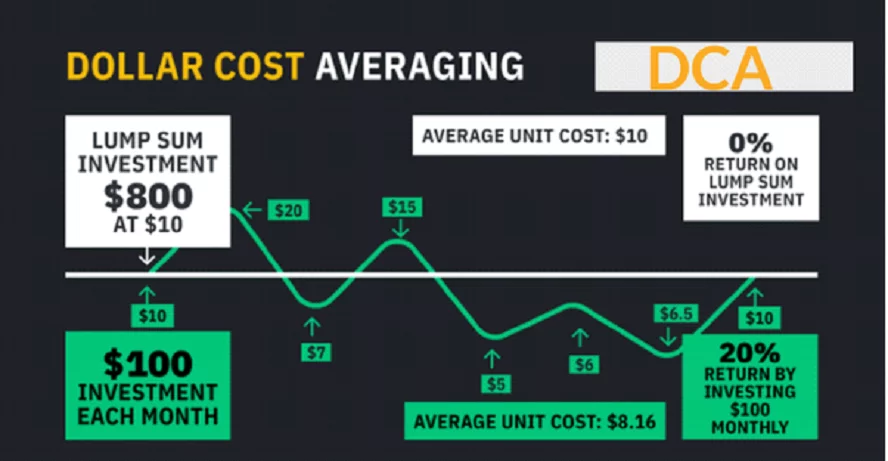

Traditionally, investors make a one-time investment in gold, silver, or platinum when the prices are down. Then, they wait for the prices to increase and sell for a profit. But investing all your capital based on trading prices is risky. Just because the prices are down doesn’t mean they will not drop lower. With Dollar-Cost Averaging, you commit to buying gold or silver at regular intervals regardless of price.

Purchasing the highs and the lows over time lowers your average unit cost. This strategy can help you take advantage of dips in gold, silver, or platinum prices. Investing in precious metals using Dollar-Cost Averaging, rather than a lump sum investment, offers higher returns in the long run.

2. Stable Long-Term Investment

Over the past 20 years, gold has delivered an annual average gain of more than 8%. It’s no wonder why investors turn to gold as a "safe haven" in trying times. Dollar-Cost Averaging with gold allows you to build your long-term investment right at the center of this economic "safe haven." The idea is to purchase a fixed-dollar amount of precious metals on a set schedule regardless of the price. The end goal? Accumulate as many ounces of gold, silver, or platinum as possible over a specific period and build a stable and secure long-term investment. But why precious metals instead of stocks or real estate? In today’s volatile and unpredictable market environment, Dollar-Cost Averaging with gold, silver or platinum can help you hedge against inflation and reduce risks by averaging out market lows.

3. Flexible Investment Plan

With Dollar-Cost Averaging, you don't need hundreds of thousands of dollars to start an investment. Use precious metals accumulation programs or gold savings accounts to invest whatever you can afford. Goldline’s Accumulation Program is customizable to your unique investment needs. You can start small with a $200/month investment for a few months and then increase your monthly target to $500 or $1,000 in the future. If you want to build a $10,000 investment, DCA programs and plans allow you to invest a certain amount of your salary. You’ll reach your long-term investment goal within a year or two.

To make the most of Dollar-Dost Averaging, invest with a reliable precious metals dealer. With over 60 years in precious metals, Goldline is one of the most experienced dealers in this sector. You can rely on Goldline’s Precious Metals Accumulation Program to leverage the benefits of Dollar-Cost Averaging and build a stable long-term investment quickly and effortlessly. To get started on your Dollar-Cost Averaging plan, contact us today!

In today’s fast-paced investment arena, market timing is crucial to success but increasingly elusive during periods of volatility. Historically, Gold, Silver, and Platinum tend to be more stable than stocks, real estate, and other investment options.